Can Cannabis Producers Buy Success?

Having spent $1,210,00,000 CAD in less than 90 days, is Hexo on track to become the #1 cannabis producer in Canada?

Friends,

A key term in the cannabis industry over the past 9 weeks is consolidation.

In Canada, producers are competing in a market where the supply of cannabis exceeds demand by 10x, and with federal legalization on the horizon in the U.S the number of mergers and acquisitions occurring in cannabis is accelerating.

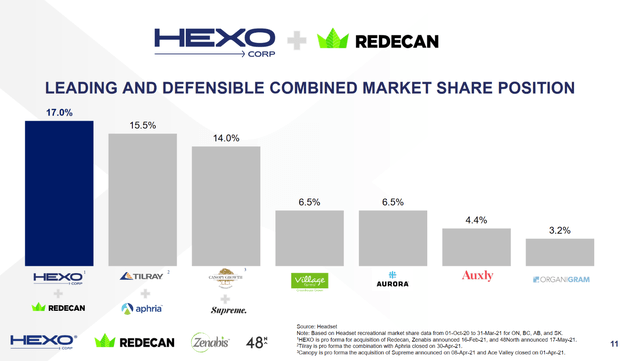

In Canada Hexo, which has been struggling to reach profitability since its inception has acquired Redecan — a company that went from being relatively unknown to becoming one of the top producers of dried cannabis in Canada.

Redecan has developed a great brand in Canada, and with a far majority of all cannabis being purchased in Canada being dried flower — Redecan is currently one of the most successful companies in the Canadian industry.

Honestly, I’m surprised that Redecan sold to Hexo as they seemingly had everything going right for them — that said $925 million CAD is a very large number, and everything in cannabis can be purchased if the price is right.

Breaking Down Hexo’s Ambitions vs Outcomes

Hexo on the other hand had ambitions to compete in the premium dried cannabis market, however, having failed to execute on this plan they decided to instead cut their prices to compete in the “value” section of cannabis.

I will highlight the growing demand for high THC products with many consumers optimizing for value where they purchase the cannabis products that have the highest THC percentages at the lowest price points possible.

If Hexo succeeds in becoming the market leader in this growing category they will certainly succeed in generating significant amounts of revenue, however, I remain unconvinced that profits will follow Hexo becoming the market leader in a category of cannabis that is currently in a race to the bottom on prices.

A Tale Of Three Parts

Redecan, on the other hand, is a different story, and if Hexo can retain the talent currently working at the company who have produced the products that have earned them such a great reputation across Canada then I would become quite bullish on Hexo succeeding in the Canadian market.

I remain neutral on the Zenabis acquisition, however, the purchase of 48 North for $50 million is one which I don’t see shareholders of the company seeing a positive return on.

Like many acquisitions that have occurred in the Canadian cannabis industry the assets of 48 North will likely be written down in value in the near future.

That said, with the acquisitions of Zenabis and Redecan I would give Hexo much better odds of succeeding in the Canadian market in the coming years than I would have prior to them having made these acquisitions.

What The Future Holds For Hexo? 🔮

With $1.21 Billion CAD spent on these three acquisitions — all within 90 days of each other, Hexo is certainly making their move to go big or go bankrupt.

Only time will tell if these bold moves by Hexo pay off, however, the acquisition of Redecan is arguably the best acquisition I’ve seen to date in the Canadian cannabis industry.

Have a great day, and I’ll talk to everyone tomorrow.