In Today’s Issue:

→ Deloitte’s Data. ✅

→ CBD Products In Europe. 💰

→ Cannabis Production Centres. 🌿

What Cannabis Consumers Want

Breaking down the data on what cannabis consumers want today…

With global cannabis sales on track to surpass $21 billion USD in 2021 — a 50% increase from 2019, a key question is what do cannabis consumers value?

In this edition of Four PM, we will be breaking down the factors that influence the cannabis products consumers are currently purchasing.

Cheap cannabis…

While the industry has seen the emergence of brands consumers love such as Kiva & Cookies, consumers in North America still love cheap weed.

In Canada, 34% of consumers said a product’s price point was the #1 factor that determined the cannabis products they purchased, while 25% of U.S consumers said the same.

Taste matters most…

Certain consumers pay a great deal of attention to product price points, however, one factor which is seemingly more important is a product’s taste.

In Canada, 32% of consumers said a product’s taste/flavor was the #1 factor that determined the products they purchased, and in the U.S some 37% of consumers said a product’s taste/flavor was the most important factor.

Consumers will pay premiums…

While certain consumers are seeking the highest THC products for the lowest price points possible — there remains a growing group of consumers who are willing to pay a premium for certain products.

The perfect example of consumers’ willingness to pay such a premium for live resin cartridges.

In California, less than 8% of cannabis vape cartridges sold in 2019 contained live resin — a more expensive cannabis concentrate.

Over 33% of cannabis vape cartridges sold in California now contain live resin.

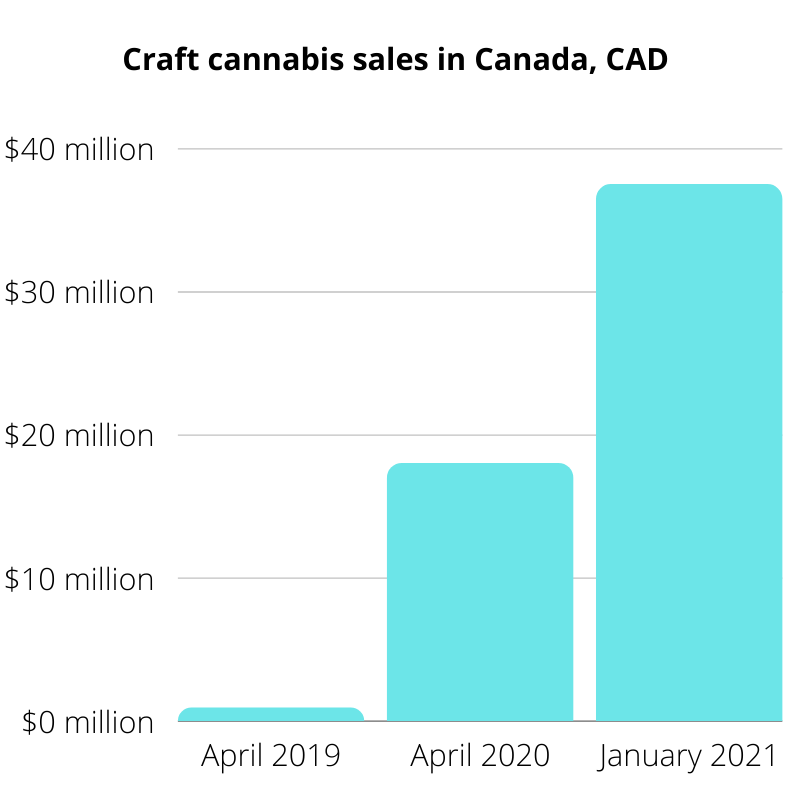

Craft cannabis…

An additional data point supports this idea.

Despite the fact that a gram of craft cannabis cost between 16-41% more than the average gram of cannabis in Canada — sales continue to soar.

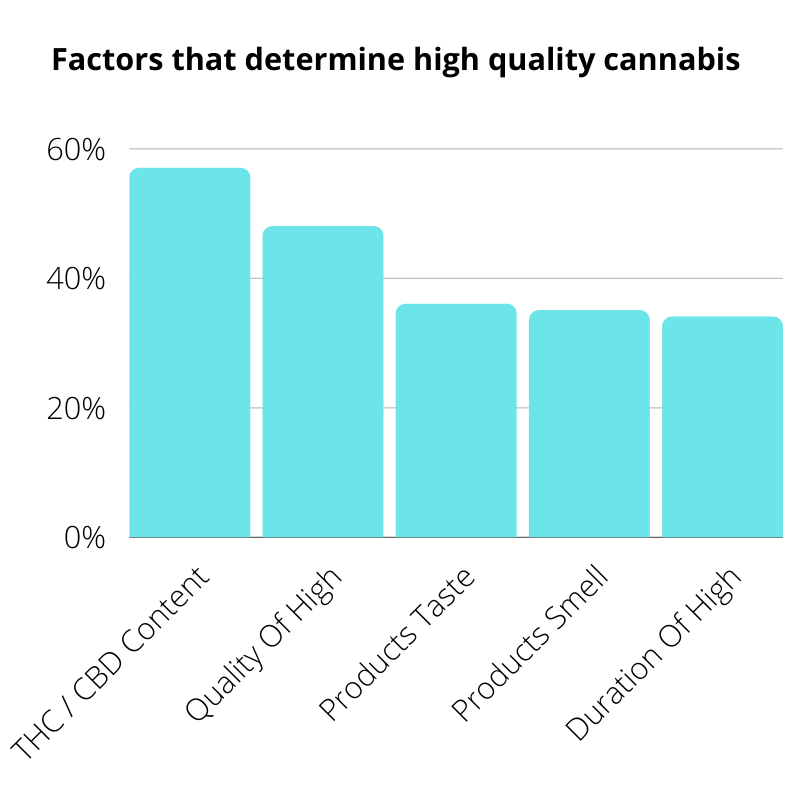

What is high quality?

If consumers are willing to pay a premium for products that they perceive to be of greater quality, this begs the question — how do consumers define high quality cannabis products?

Our Take

Cannabis is such a unique CPG product, however, it is also very similar to every other CPG product in that certain consumers are willing to pay a premium for products they perceive to be of higher quality.

As several Canadian producers race to the button on products prices, it would be wise to focus on increasing the perceived quality of products as opposed to resorting to price reductions.

How Will Europe Regulate CBD?

Home to 446 million people, the E.U is considering changing its CBD laws…

Europe may have some catching up to do when it comes to THC, however, they have been ahead of North America when it comes to regulating CBD.

While CBD products can only be sold in cannabis retail stores in Canada, CBD brands in Europe can have their products carried by any store.

Constant change…

In 2020, the European Commission said they viewed CBD as a Schedule I drug which would subject CBD to the same regulations as THC in the U.S today.

Months later in a court case involving a french vape company, they concluded that CBD cannot be considered a Schedule I drug if it were manufactured within the bounds of the law in another E.U Member state.

Cracking down on CBD…

Early this year the International Narcotics Control Board announced its Cannabis Initiative.

Within this new initiative is text which suggests change is coming for CBD companies in Europe.

In a leaked draft that was first discovered in February 2021, the initiative is seeking to subject CBD to the Single Convention on Narcotic Drugs.

‘CBD is not specifically listed in the Schedules of the Single Convention of 1961 or the 1971 Convention, it is considered under control as an extract of cannabis under the Single Convention.’

Looking forward…

Total sales of CBD products exceeded $520 million USD in Europe in 2020.

This represents 31% of the global CBD market share, second only to North America which accounts for 40% of all CBD product sales.

Should the E.U once again change its position on CBD it could have very serious consequences for companies operating in the region.

Our Take

Given the current availability of CBD products in Europe courtesy of the companies that have helped build the industry — it would be a shame to see the E.U move backwards on cannabis.

With several European nations generating significant revenue from CBD, these regulations won’t receive widespread adoption resulting in a similar situation to what we see in the U.S today with THC.

The Cannabis Production Centres

Which states are benefiting the most from cultivating cannabis today?

In Wednesday’s edition of Four PM, we highlighted that cannabis has become the 5th most valuable crop in America today.

With more than $6 billion USD in wholesale revenue in the last 12 months, several states have been generating substantial revenue from legalizing the production & consumption of cannabis.

Alaska…

With limited opportunity to produce crops in Alaska today, courtesy of its cold climate, cannabis is currently the top crop in the region.

Alaska currently has 356 licensed cannabis farms that collectively produced 21 metric tons of cannabis during the fiscal year from June 2020 to June 2021, resulting in $104 million USD wholesale revenue.

While $104 million USD in revenue might not seem like much, this is over 10x the second most valuable crop in the state (hay) which generated just short of $9 million during this same period.

California…

From June 2020 to June 2021, California harvested 514 metric tons of cannabis, resulting in $1.66 billion USD in wholesale revenue.

In addition to the state's 50,000 illegal cultivation sites, there’s an estimated 7 cannabis farm licenses for every adult-use store open in California today.

Colorado…

Colorado farmers produced an estimated 627 metric tons of cannabis in 2020.

Like California, Colorado has issued more cannabis cultivation licenses than stores with 1,245 cultivation licenses and just over 1,000 stores.

Despite having produced more cannabis than California, Colorado’s 627 metric tonnes of cannabis were valued at $1.03 billion last year.

Oregon…

Cannabis is the top crop in Oregon today, generating over $602 million USD in wholesale revenue in the last 12 months.

Despite having the most cannabis retail stores per capita in the country — Oregon has also issued significantly more cannabis cultivation licenses vs the number of cannabis retail stores.

At the beginning of this year, the state was home to 660 cannabis retail stores, however, they had issued 1,319 cannabis cultivation licenses, producing a total of 344 metric tons of cannabis last year.

Looking forward…

It’s very hard to say with certainty which regions will be the primary production centers for the U.S cannabis industry 10 years from now.

States such as California seem perfectly positioned to supply cannabis to other states, however, states could put protections in place to ensure local producers won’t be put out of business.

Our Take

It’s great to see so many states benefiting from producing cannabis today, however, long term a key problem that will need to be solved is the environmental impact of certain indoor grows.

Given enough time all cannabis production facilities will likely move to the regions where producing cannabis can be done most efficiently, assuming the regulations allow this to occur.

For more like this, subscribe to Four PM today to receive the next edition:

Today's Cannabis Jobs

→ Greenline is hiring a Social Media Manager.

→ LeafLink is hiring a Customer Support Agent.

→ Dutchie is hiring a Manager, Strategic Finance.

For more, check out our new cannabis jobs board.

If you gained value from this edition of Four PM, share it with your favorite cannabis professionals. 🌎