The Biggest Does Not = The Best In Cannabis 💸

An honest assessment of Aphria's planned takeover of Tilray

Friends,

Something very odd occurred in the Canadian cannabis industry yesterday.

On Tuesday evening it was first reported by @BettingBruiser that Canadian cannabis companies Aphria and Tilray were in advanced talks to complete a merger.

This isn’t the first time this year that Aphria participated in such discussions, with previous talks held with Aurora Cannabis—one of the many Canadian producers who bit off more than they could chew and seemingly found themselves drowning in debt.

Yesterday morning, at around 8 AM EST, both companies confirmed these discussions, and soon after announced that they would be completing a merger.

🌰 The deal in a nutshell

The combined entities would be the “world’s largest cannabis company” with revenue of $874 million CAD over the past 12 months.

Under the merger, the new company would operate under the Tilray name.

It’s very likely that Tilray will close its Canadian cultivation facilities once the merger agreement has been completed.

Pending approval from the regulators, the deal would be completed in Q2 2021.

Aphria shareholders will own roughly 62% of the new company, which will be led by Aphria CEO Irwin Simon.

Cost-saving synergies from the merger are estimated to reach $100 million CAD within 24 months, the companies said; how—ever, I’ll believe this when I see it in their earnings reports.

Aphria CEO Irwin Simon also articulated a bullish outlook for the combined company’s European operations, saying he sees “a good chance” for recreational legalization in Germany and Portugal in 2021, something I’m very skeptical of.

Why this deal doesn’t make any sense…👇🏽

Aphria is one of the very few Canadian cannabis companies that are currently closing in on the highly coveted profitability, with annual revenue of over $500 million CAD.

All things considered, Aphria is doing pretty damn well here in Canada compared to many of their Canadian counterparts.

Tilray on the other hand, is a company currently on the fast track towards bankruptcy, with over $515 million USD in debt—and profitability far out of reach.

In a matter of months Tilray’s assets would have been up for auction for pennies on the dollar, which begs the question: how much will Aphria’s impatience cost them?

The Daily Newsletter For Cannabis Professionals

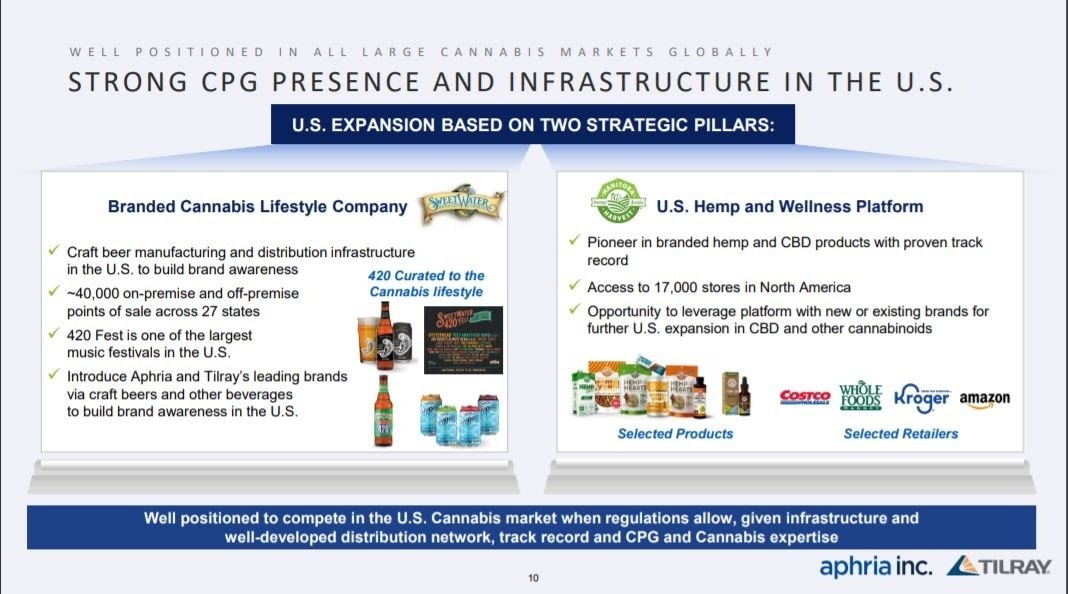

A key point in favor of the deal that Aphria has been emphasizing is Tilray’s exposure to the U.S. market. This is news to me.

Manitoba Harvest, a company Tilray paid just shy of $420 million CAD for in 2019, specializes in hemp-based food products. How exactly this will help Aphria capture market share in the U.S once cannabis does become federally legal, I will never know.

One of the more interesting aspects of this deal is the decision to retain the Tilray name, with the logic being that it has greater brand awareness in the U.S.

The fact that this is one of the more interesting parts of this deal says a lot, as I’m sure if you were to poll every cannabis consumer in the U.S. today, barely 2% would even recognize the name Tilray.

Another key point that Aphria has emphasized is the potential for explosive growth in the European cannabis market. But if Tilray is struggling to compete for market share in its own backyard (Canada), then how will this help Aphria capture market share in Europe?

🥁 Drumroll please… it won’t.

The combined company will have over $1,000,000,000 CAD in debt (One billion and forty-one million to be exact) and there’s nothing that conveys confidence to investors than having more debt than revenue, and—oh yeah—assets that are depreciating in value faster than the time it would take to incinerate the mountains of low-quality cannabis Tilray currently has sitting in the vaults.

At this point, the storage costs of this cannabis likely outweigh whatever these products are even worth. 💰

Perhaps the joke is on me here, as I’m failing to understand some details which I simply can’t wrap my mind around, however, having read every detail of this deal, I can’t understand why Aphria is seeking to offer up 38% of its stock.

If I’m wrong, I’ll be the first to admit it; however, unless Tilray has recently invented a printing press that will allow it to print the $515 million USD in outstanding debt, then something tells me I’m probably right on this occasion.

👉 If you enjoyed reading this post, feel free to share it with friends!

… For more like this, make sure to sign up here: