Why Shopify Should Buy Dutchie For A Billion Dollars 💰

Shopify may be leading global e-commerce, however, Dutchie is the name when it comes to cannabis e-commerce

Welcome to Four PM where we grow, harvest, and deliver the freshest cannabis industry insights. If you want to skip the queue join Four PM below. 🔹️🔷️

Friends,

A question that I’ve been asking myself for quite some time is which established technology company is the most likely candidate to capture meaningful market share in the cannabis industry?

With Amazon currently permitting CBD products to be sold on their platform in the U.K, one could argue that big tech has already sunk its teeth into cannabis.

As things stand today, however, no “established” technology company has captured any meaningful amount of market share in cannabis globally.

In large part, this is due to cannabis being a Schedule I drug in the U.S… But there is one company that I’ve been keeping a very close eye on: Canadian tech darling Shopify, which is currently valued at over $142 billion USD.

Does Shopify care about the cannabis industry?

It certainly seems like Shopify has taken an interest in the cannabis industry.

Just weeks before Canada legalized cannabis, Shopify’s president, Harley Finkelstein, went on CNBC to discuss the company’s intention to capture as much market share as possible in the industry. -

“The reason we started with Canada was that there’s clarity in Canada. The Canadian government, the legislature were very clear on how they were going to roll out the commercialization and the legalization of cannabis sales on the consumer side.

We felt it was really important for us to act quickly and effectively to not only win as much of the Canadian market as we possibly could, but also to show the rest of the world, as they begin to think about cannabis sales, that we (shopify) are the first phone call they should be making.”

However, in spite of this ambitious outlook, Shopify has failed to capture significant market share here in Canada.

Four PM Fact: One of the very few angel investments that Harley Finkelstein made was cannabis company Herb, as part of the company's seed round.

(📸 / Harley Finkelstein)

Custom cannabis software rules the day

Shopify’s potential participation in the cannabis industry can be broken down into two categories: Point of Sale software and e-commerce software.

Point of Sale software:

The cost of using Shopify’s POS platform is $29 per month, but the POS companies that have captured the majority of the market share here in Canada are Greenline POS and Cova—in spite of both charging over 15x what Shopify charges.

How can these companies charge so much? you ask. In two words: regulatory compliance.

One of the most difficult aspects of operating a cannabis retail store in any region of the 🌍 is ensuring that everything that happens within your store is done to the letter of the law, that way you don’t lose your license. As such, stores are willing to pay significant premiums to ensure they remain compliant.

If Shopify were intent on capturing market share in this area, it would require them to develop custom software solutions for each province in Canada and every region outside of Canada—something much easier said than done.

Cannabis news and analysis with a focus on founders and startup teams

E-commerce software:

This is one area I personally expected Shopify to dominate, as the regulatory burden it would have to shoulder is much lighter than providing POS software. But this is another area where Shopify has fallen very far behind.

Why is Shopify failing to capture market share in this area? Simply put, another competitor has developed a better solution and Shopify is having a hard time catching up. That competitor is Dutchie.

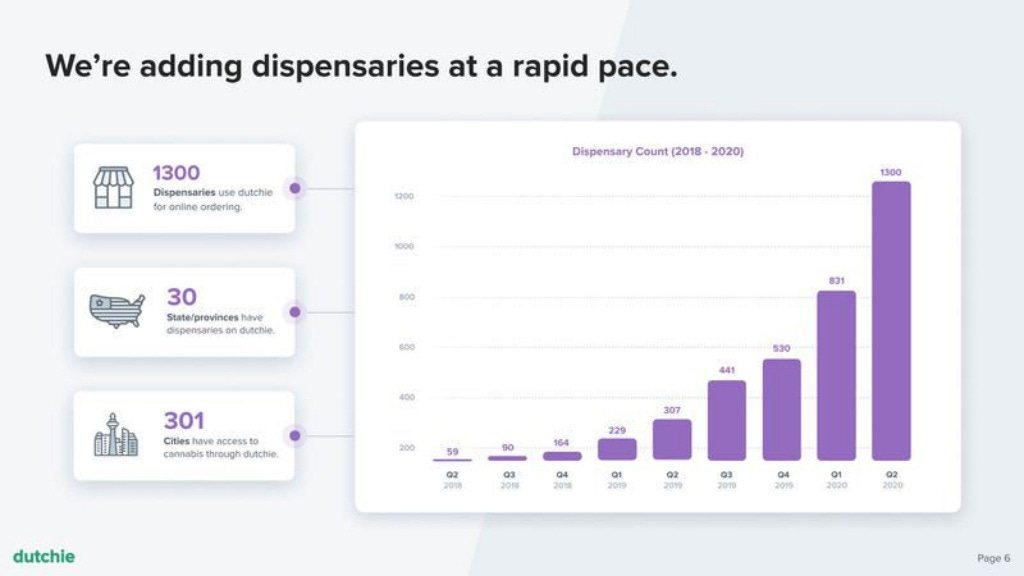

Just as Shopify has benefited from the global pandemic as the bulk of all sales have transitioned online, so has Dutchie, which has more than doubled its market share since the beginning of this year.

This exponential growth is once again reflected in their total sales: moving from just over $100 million USD in 2019 to over $2.3 billion USD in 2020, with over 33% of all online cannabis sales taking place through Dutchie in Q2 of this year.

Why should Shopify buy Dutchie? 💰

Dutchie raised $35 million USD for their series B in August of this year, which likely gives Dutchie a valuation somewhere in the region of $200 million USD since startups typically sell 20% of their company when they raise capital.

With Dutchie growing at such a rapid rate, it’s highly unlikely that the company would entertain an offer in the region of their last valuation. Then again, what if Shopify made Dutchie an offer it simply couldn't refuse?

Let's say somewhere in excess of $1 billion USD (which is less than 1% of their market cap). Given its strong interest in the cannabis industry globally, I would be willing to bet that Shopify's market cap would increase far in excess of the billion dollars it would likely take to complete this purchase.

Everything has a price, and if Shopify would like to fulfill their ambition of becoming the first phone call any nation makes when they get ready to sell cannabis, then it should be crystal clear what has to happen next.

Interested In Staying Up-To-Date? 🔹️🔷️

You won’t have to worry about missing anything.